COSCO SHIPPING International (Singapore) Co., Ltd. (“COSCO SHIPPING” or the “Company” and together with its subsidiaries, the “Group”) aims to become the best-integrated logistics service provider in South and Southeast Asia. The Company is also involved in dry bulk shipping, ship repair and marine engineering, as well as property management.

Financials

Half Year Financial Statement Announcement And Related Announcement

Financials Archive![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

Condensed Interim Financial Statements For the six months ended 30 June 2025

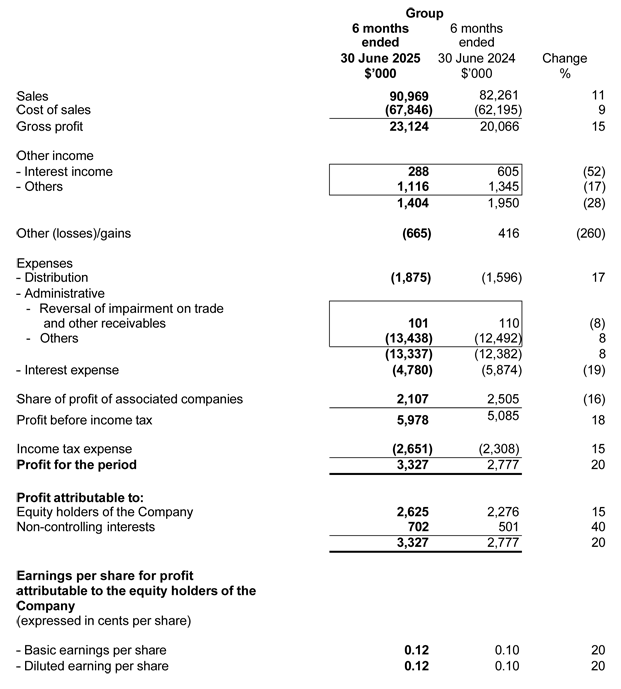

Condensed consolidated statement of profit or loss

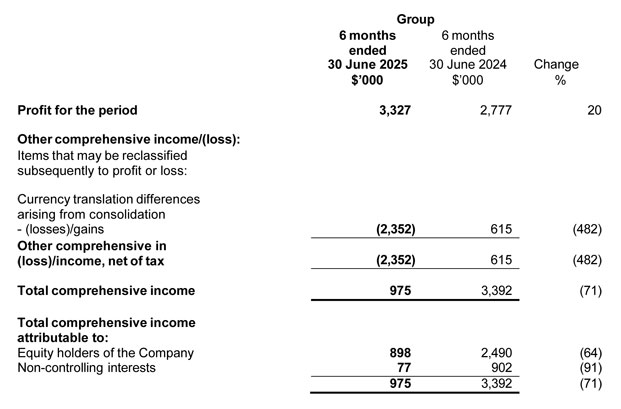

Condensed consolidated statement of comprehensive income

Review of performance of the Group

Sales

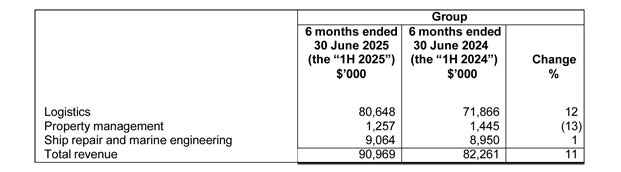

Group revenue for 1H 2025 totalled $91.0 million, 11% higher than 1H 2024.

Logistics activities accounted for about 89% of the Group’s revenue in 1H 2025. Revenue from logistics activities increased by 12% to $80.6 million mainly due to higher revenue from transportation services and container depot services.

Revenue from property management decreased by 13% to $1.3 million, mainly due to the decrease in revenue from CLC and CRC under Cogent.

Revenue from ship repair and marine engineering increased by 1%, mainly due to higher revenue from ship repair and fabrication works.

Costs and Profitability

Cost of sales increased by 9% or $5.6 million, in line with the increase in revenue from supply chain management services, transportation services and ship repair & marine engineering.

Gross profit increased by 15% from $20.1 million in 1H 2024 to $23.1 million in 1H 2025, mainly due to higher gross profit margins from Logistics and Ship repair and marine engineering activities.

Other income decreased by 28% from $2.0 million to $1.4 million in 1H 2025 because of no settlement income and government grants. Interest income decreased by 52% from $0.60 million to $0.29 million in 1H 2025, mainly due to decrease in interest rates in bank deposits and cash at bank.

Other losses were higher compared to 1H 2024 due to higher foreign exchange loss.

Administrative expenses increased by 8%, mainly due to higher costs for corporate functions.

Finance costs decreased by 19% to $4.8 million, mainly due to repayment of borrowings.

Share of profit of associated companies of $2.1 million was contributed by the Group’s 40% shareholdings in COSCO SHIPPING Bulk SEA (“COSCO SHIPPING Bulk”), 40% shareholdings in PT. Ocean Global Shipping Logistics, 30% shareholdings in SINOVNL Company Limited, and 49% shareholdings in Goldlead Supply Chain. The decrease in share of profit of associated companies was mainly due to lower profit contribution from COSCO SHIPPING Bulk.

Income tax expense increased by 15% to $2.7 million mainly due to higher profits as compared to 1H 2024.

Overall, net profit attributable to equity holders was $2.6 million, 15% higher than 1H 2024, mainly due to higher profit margins and lower interest expense, partially offset by higher administrative expenses and lower other income.

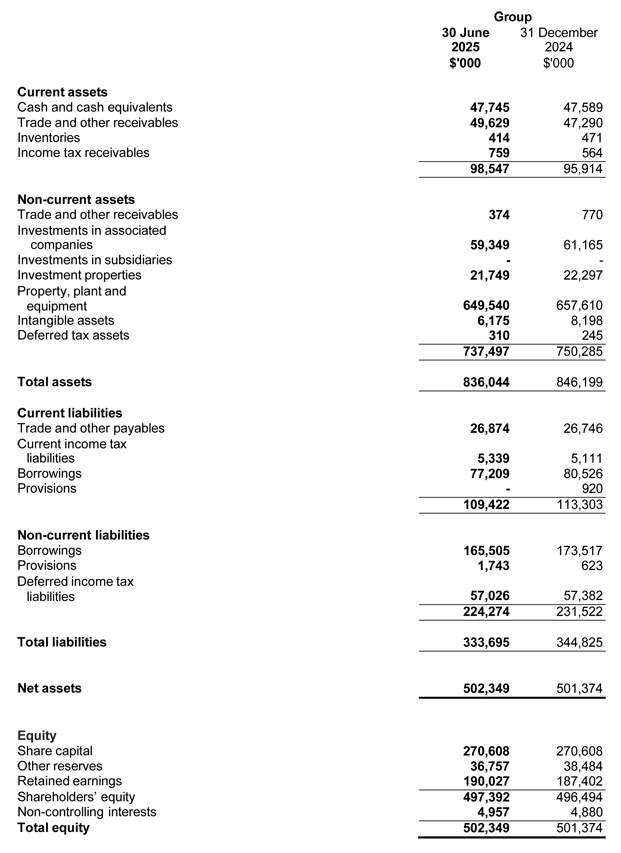

Balance Sheet

(30 June 2025 vs 31 December 2024)

Cash and cash equivalents increased from $47.6 million to $47.7 million, mainly due to net cash used in repayment of borrowings and interest payments, offset by net cash provided by operating activities. Please refer to condensed consolidated statement of cash flows for more details.

Trade and other receivables increased by $1.9 million to $50.0 million (31 December 2024: $48.1 million).

Property, plant, and equipment decreased by $8.1 million to $649.5 million, mainly due to depreciation expense recognised in 1H 2025.

Total borrowings decreased by $11.1 million to $242.7 million, mainly due to repayment of borrowings from Singapore and Malaysia.

Shareholder’s equity increased by $0.9 million to $497.4 million mainly due to profit for the period, offset by currency translation losses.

Cash Flow

Net cash provided by operating activities for 1H 2025 was $21.2 million mainly due to working capital movements for operations. Please refer to consolidated statement of cash flows for details.

Net cash provided by investing activities for 1H 2025 was $1.8 million. This was mainly due to dividend received from investment in an associated company.

Net cash used in financing activities for 1H 2025 was $22.9 million. This was mainly due to the repayment of borrowings and interest.

Commentary

The global economic environment in 2025 remains challenging, marked by heightened uncertainty stemming from a resurgence of trade protection policies, including renewed U.S. tariffs on imported goods, and escalating geopolitical tensions across several regions. These negative trends have increased market volatility and affected global supply chain operations.

In July 2025, the International Monetary Fund (IMF) projected global growth at 3.0%, an upward revision of 0.2 percentage points from its April 2025 projection. The improvement reflects front-loading of trade activities ahead of tariffs, lower effective tariff rates, improved financial conditions, and fiscal expansion in some major jurisdictions. Locally, the Ministry of Trade and Industry Singapore (MTI) announced on 14 July 2025 that Singapore’s Gross Domestic Product (GDP) growth for the first half of 2025 averaged 4.2 per cent year-on-year. Looking forward, however, significant uncertainty and downside risks remain in the global economy for the second half of 2025, particularly due to the lack of clarity surrounding U.S. tariff policy.

In response to capital needs, in particular for the development of Jurong Island Logistics Hub (“JILH”) Phase II and repayment of bank borrowings, the Company announced in August 2024 its proposal to undertake a renounceable non-underwritten rights issue (the “Rights Issue”) to raise gross proceeds of approximately S$273.2 million.

On 8 July 2025, the application for subscription of Rights Shares and excess Rights Shares was opened to shareholders. The Rights Issue closed on 22 July 2025, and the results was announced by the Company on 25 July 2025. On 29 July 2025, the Company announced that the Rights Shares would be listed and quoted on the Main Board of the SGX-ST on 30 July 2025 and trading of the Rights Shares would commence with effect from 9.00 a.m. on the same day.

The Company, through its wholly owned subsidiary Cogent Jurong Island Pte Ltd, marked a significant milestone with the groundbreaking ceremony for JILH Phase II in December 2024. Construction officially commenced in June 2025. The project is expected to complete in the last quarter of 2026.

In 1H2025, the Company made great efforts to keep its business operation stable and made good progress. Step by step, the Company is integrating and restructuring its business operations in Malaysia by centralising warehousing, container depot and land transportation businesses in Malaysia, so as to maximise the business operation in relevant business units and achieve maximum benefit.

Amidst macroeconomic headwinds, the Company remains committed to long-term growth and resilience. It will continue to monitor developments in the logistics and supply chain sectors across Singapore, Malaysia, and Southeast Asia, and look for opportunities to invest in infrastructure and network expansion that are strategically appropriate. The Company strives to become a leading integrated shipping and logistics service provider in Southeast and South Asia, while delivering sustainable value to its shareholders.

Condensed Balance Sheets - Group