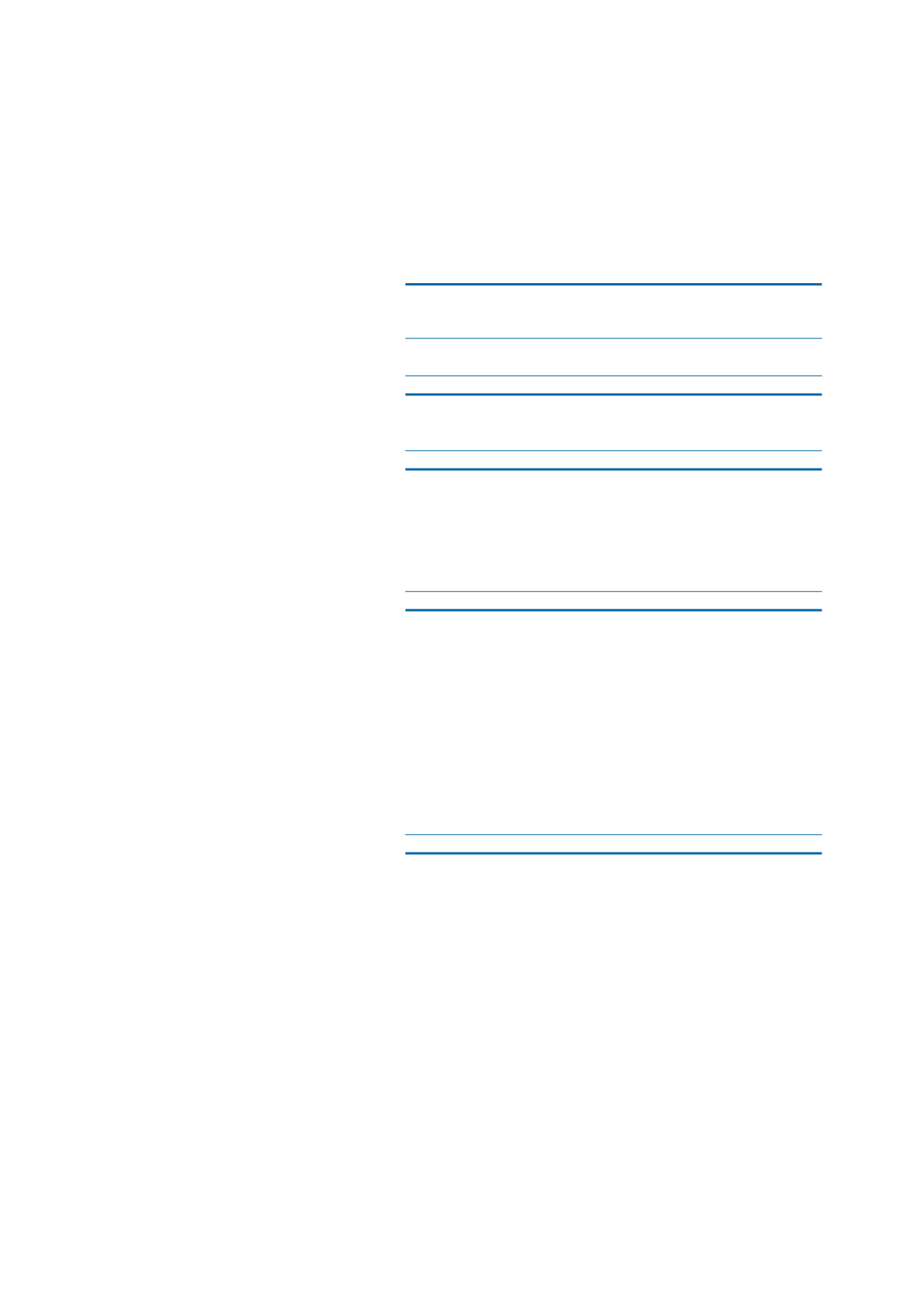

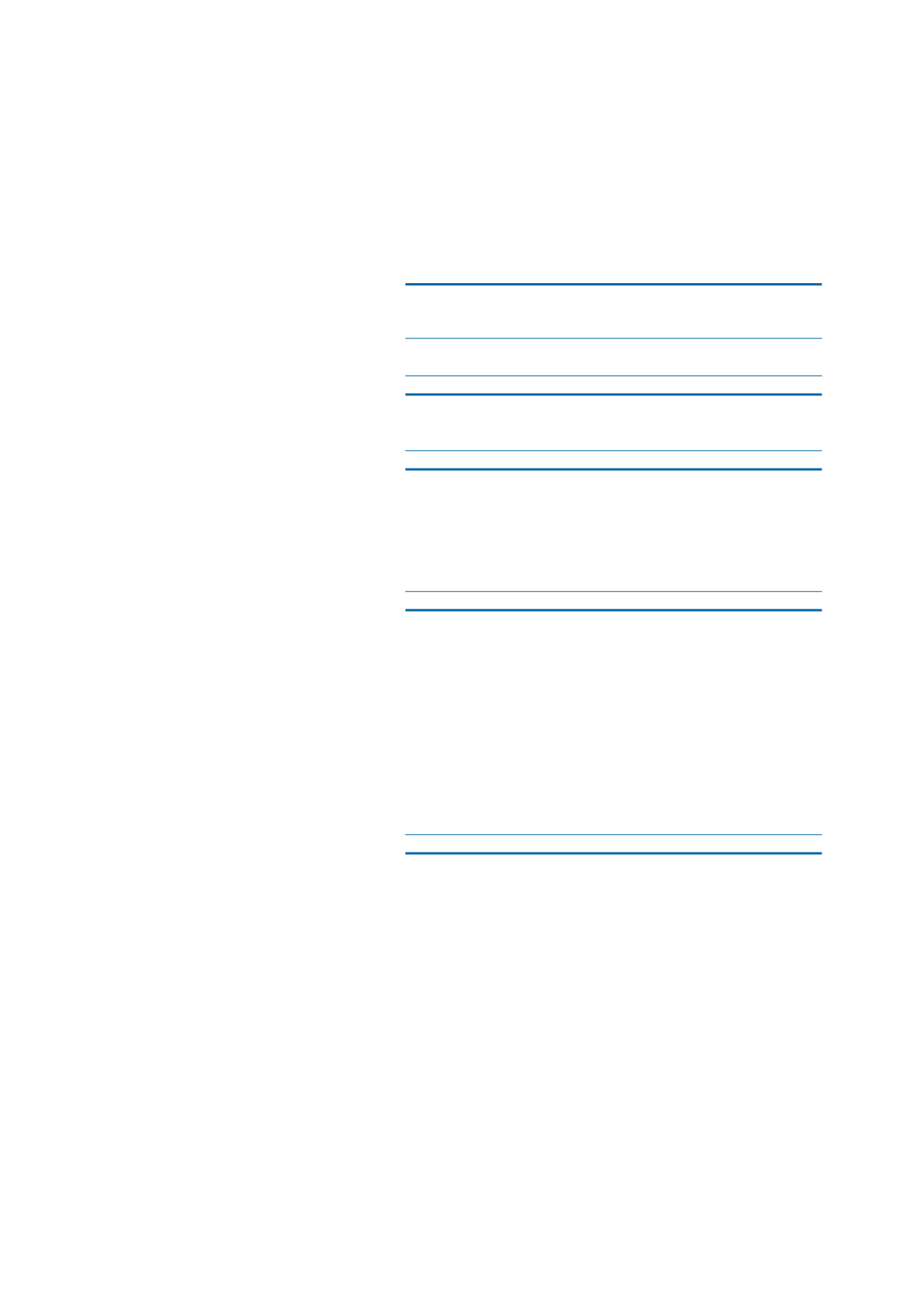

FIVE-YEAR SUMMARY

Financial Statements

148

COSCO Corporation (Singapore) Limited

Note

2010

2011

2012

2013

2014

$’000

$’000

$’000

$’000

$’000

PROFIT OR LOSS

Sales

3,861,445 4,162,921 3,734,261 3,508,134 4,260,705

Operating profit before taxation

401,873

286,842

229,041

60,535

17,448

Share of (loss)/profit of

associated companies

1

(27)

717

580

407

(197)

Profit before income tax

401,846

287,559

229,621

60,942

17,251

Income tax (expense)/credit

(43,420)

(74,195)

(59,842)

(8,157)

9,026

Net profit

358,606

213,364

169,779

52,785

26,277

Attributable to:

Equity holders of the company

248,837

139,671

105,685

30,615

20,893

Non-controlling interests

109,769

73,693

64,094

22,170

5,384

Net profit

358,606

213,364

169,779

52,785

26,277

Dividend

2

89,570

67,177

44,785

22,392

11,196

BALANCE SHEET

Share capital

270,608

270,608

270,608

270,608

270,608

Statutory and other reserves

103,950

181,320

152,927

245,139

284,328

Retained earnings

824,059

849,305

857,971

820,027

812,819

Non-controlling interests

595,860

699,241

767,699

839,307

861,750

Total equity

1,794,477 2,000,474 2,049,205 2,175,081 2,229,505

Trade and other receivables

49,089

63,867

44,344

36,874

4,377

Available-for-sale financial assets

3,434

4,407

4,244

4,391

4,841

Club memberships

557

390

310

303

303

Investments in associated companies

3,569

4,102

4,235

4,826

4,736

Investment properties

14,619

14,405

11,730

11,293

10,990

Property, plant and equipment

2,207,952 2,412,126 2,225,689 2,227,868 2,267,057

Intangible assets

9,468

9,526

9,477

9,539

9,564

Deferred expenditure

3,169

3,211

3,020

3,066

3,029

Deferred income tax assets

212,703

241,513

201,914

225,212

267,901

Current assets

3,548,782 4,246,963 4,888,594 6,211,360 7,372,499

Current liabilities

(3,817,496) (4,496,234) (3,778,379) (4,702,660) (5,172,565)

Non-current liabilities

(441,369)

(503,802) (1,565,973) (1,856,991) (2,543,227)

Net Assets

1,794,477 2,000,474 2,049,205 2,175,081 2,229,505

RATIOS

Basic earnings per share (cents)

3

11.1

6.2

4.7

1.4

0.9

Dividend per share (cents)

4.0

3.0

2.0

1.0

0.5

Dividend cover (times)

4

2.8

2.1

2.4

1.4

1.9

Net tangible assets per share (cents)

53.1

57.7

56.8

59.2

60.7

Gearing ratio (Net of Cash)

5

0.1

0.4

1.0

1.3

2.5

Notes

1.

The share of (loss)/profit of associated companies is net of tax.

2.

The dividend for 2014 is calculated based on the number of shares issued as of 31 December 2014. The

actual amount payable will be based on the number of shares issue at book closure date, which will be

accounted for in equity as an appropriation of retained earnings in the financial year ending 31 December

2015.

3.

Basic earnings per share is calculated as net profit attributable to equity holders of the company divided by

the weighted average number of ordinary shares issued in the financial year.

4.

The dividend cover is calculated as net profit attributable to equity holders of the Company divided by the

amount of equity dividend.

5.

Gearing ratio is derived by taking total borrowings (net of cash) over the shareholders’ funds.