NOTES TO THE FINANCIAL STATEMENTS

For the financial year ended 31 December 2014

Financial Statements

126

COSCO Corporation (Singapore) Limited

29.

Deferred income taxes

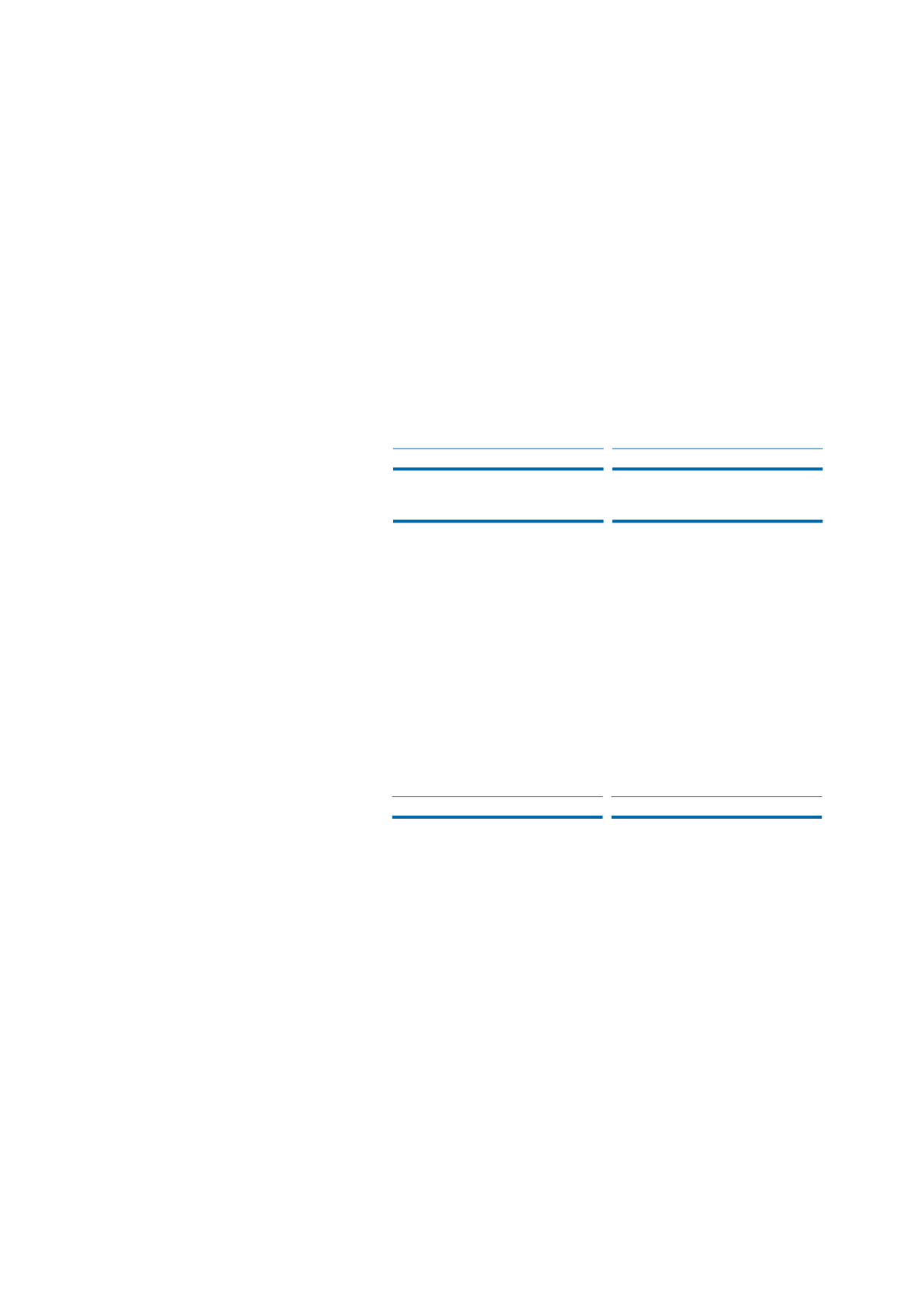

Deferred income tax assets and liabilities are offset when there is a legally enforceable right to offset current

income tax assets against current income tax liabilities and when the deferred income taxes relate to the

same fiscal authority. The amounts, determined after appropriate offsetting, are shown on the balance

sheets as follows:

The Group

The Company

2014

2013

2014

2013

$’000

$’000

$’000

$’000

Deferred income tax assets:

- To be recovered within one year

260,924

218,756

–

–

- To be recovered after one year

6,977

6,456

–

–

267,901

225,212

–

–

Deferred income tax liabilities:

- To be settled after one year

837

528

704

398

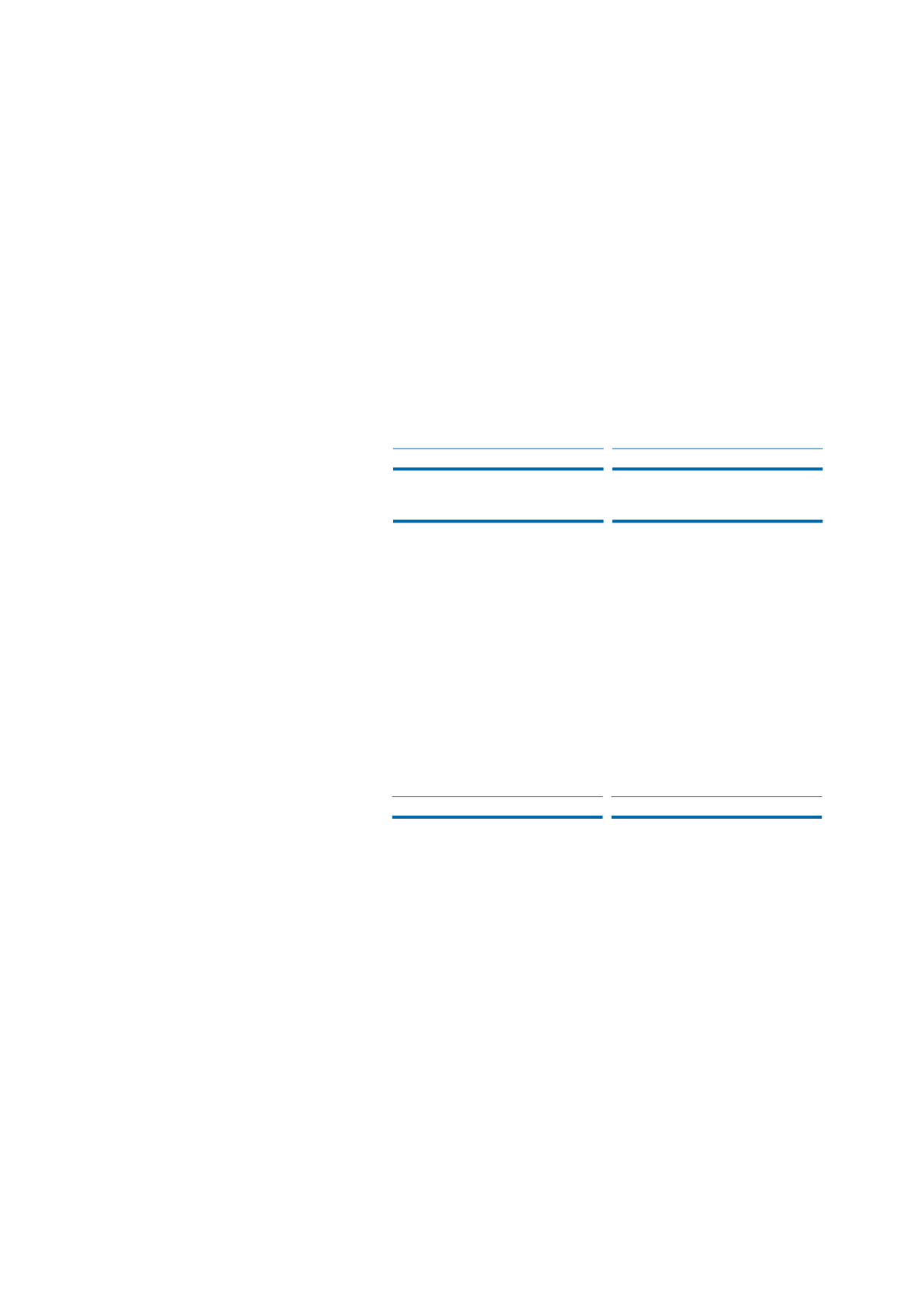

Movement in the deferred income tax account is as follows:

The Group

The Company

2014

2013

2014

2013

$’000

$’000

$’000

$’000

Beginning of financial year

(224,684)

(194,482)

398

7,302

Change in tax rate

–

3,299

–

–

Currency translation differences

(6,794)

(13,109)

12

137

Deferred tax (credited)/charged to

profit or loss

(35,669)

(20,361)

294

(7,041)

Deferred tax charged/(credited) to

other comprehensive income

(Note 31(b)(v))

83

(31)

–

–

End of financial year

(267,064)

(224,684)

704

398

Deferred income tax assets are recognised for tax losses, provisions and accruals carried forward to the

extent that realisation of the related tax benefits through future taxable profits is probable. The Group has

unrecognised tax losses of $32,091,000 (2013: $20,579,000) for which no deferred tax asset has been

recognised at the balance sheet date which can be carried forward and used to offset against future

taxable income subject to meeting certain statutory requirements by those companies with unrecognised

tax losses in their respective countries of incorporation. The unrecognised tax losses will mainly expire in

2018.