NOTES TO THE FINANCIAL STATEMENTS

For the financial year ended 31 December 2014

Financial Statements

135

Annual Report 2014

34.

Financial risk management

(continued)

(a)

Market risk (continued)

(i)

Currency risk (continued)

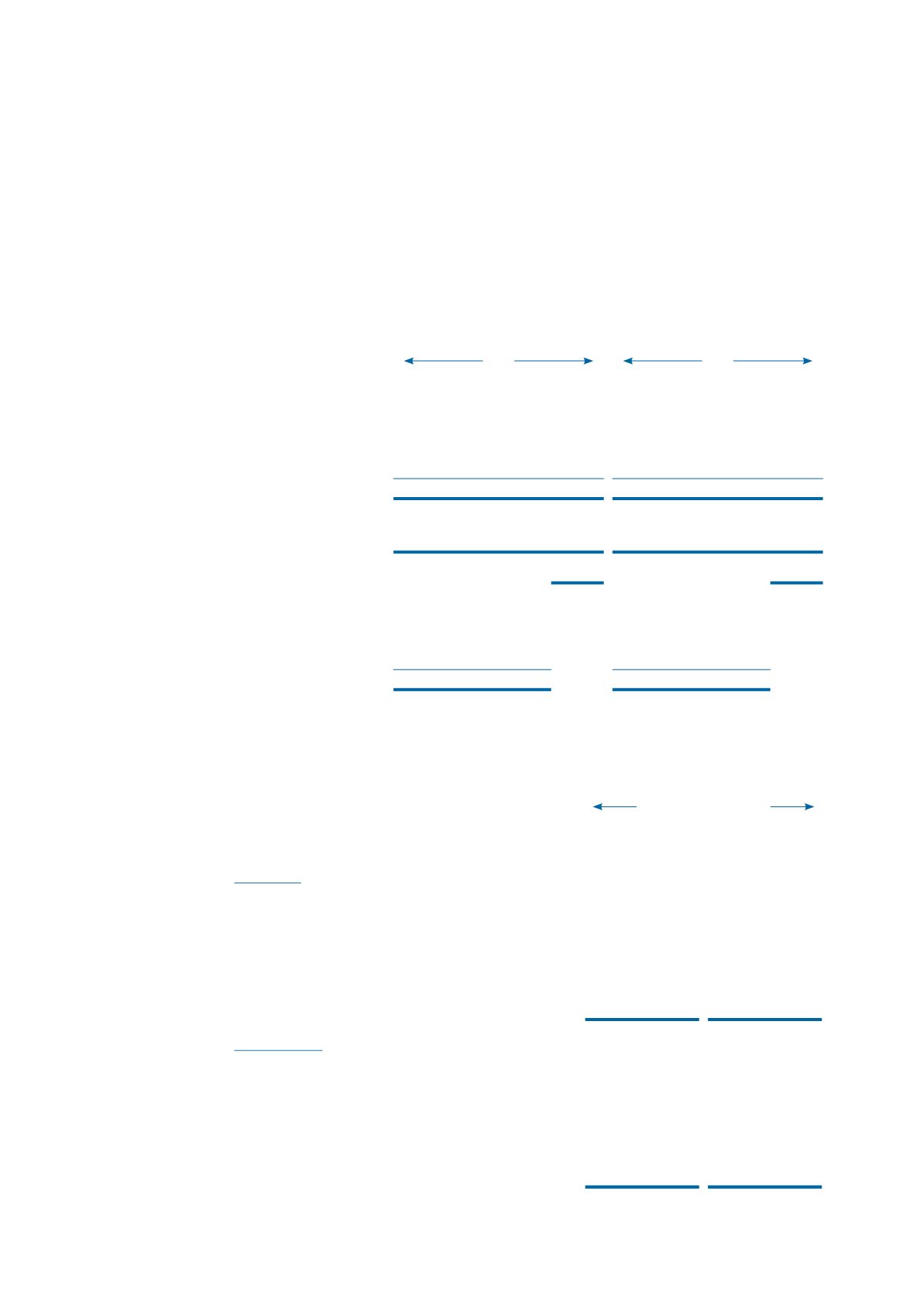

The Company’s currency exposure based on the information available to key management is

as follows:

2014

2013

SGD USD RMB Total

SGD USD RMB Total

$’000 $’000 $’000 $’000

$’000 $’000 $’000 $’000

Financial assets

Cash and cash equivalents

19,667 26,766

1 46,434

2,295 52,112

1 54,408

Trade and other receivables

56

– 31,085 31,141

1,411

4 30,359 31,774

19,723 26,766 31,086 77,575

3,706 52,116 30,360 86,182

Financial liabilities

Other financial liabilities

17,378

–

– 17,378

18,147

–

2 18,149

Net financial assets/(liabilities)

2,345 26,766 31,086 60,197

(14,441)

52,116 30,358 68,033

Less: Net financial

assets/(liabilities)

denominated in the

entity’s functional

currency

(2,345)

–

–

14,441

–

–

Currency exposure

– 26,766 31,086

– 52,116 30,358

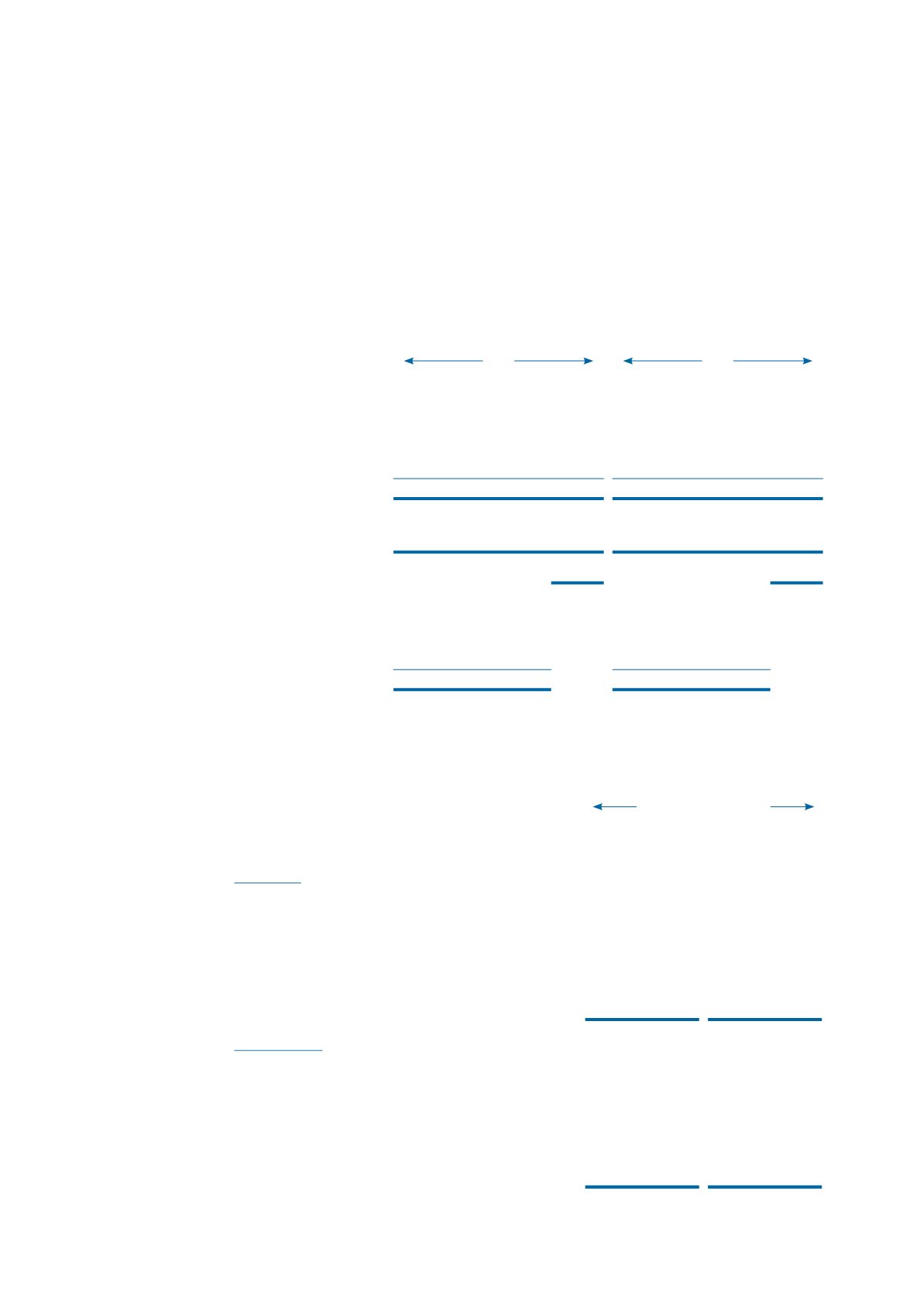

If the USD changes against the SGD and RMB by 500 basis points (2013: 500 basis points)

with all other variables including tax rate being held constant, the effects arising from the net

financial asset position will be as follows:

2014

2013

Increase/(decrease)

Profit after tax

Profit after tax

$’000

$’000

The Group

USD against SGD

- Strengthened

810

1,712

- Weakened

(810)

(1,712)

USD against RMB

- Strengthened

(2,040)

(1,461)

- Weakened

2,040

1,461

The Company

USD against SGD

- Strengthened

838

1,713

- Weakened

(838)

(1,713)

RMB against SGD

- Strengthened

6,040

6,040

- Weakened

(6,040)

(6,040)