NOTES TO THE FINANCIAL STATEMENTS

For the financial year ended 31 December 2014

Financial Statements

127

Annual Report 2014

29.

Deferred income taxes

(continued)

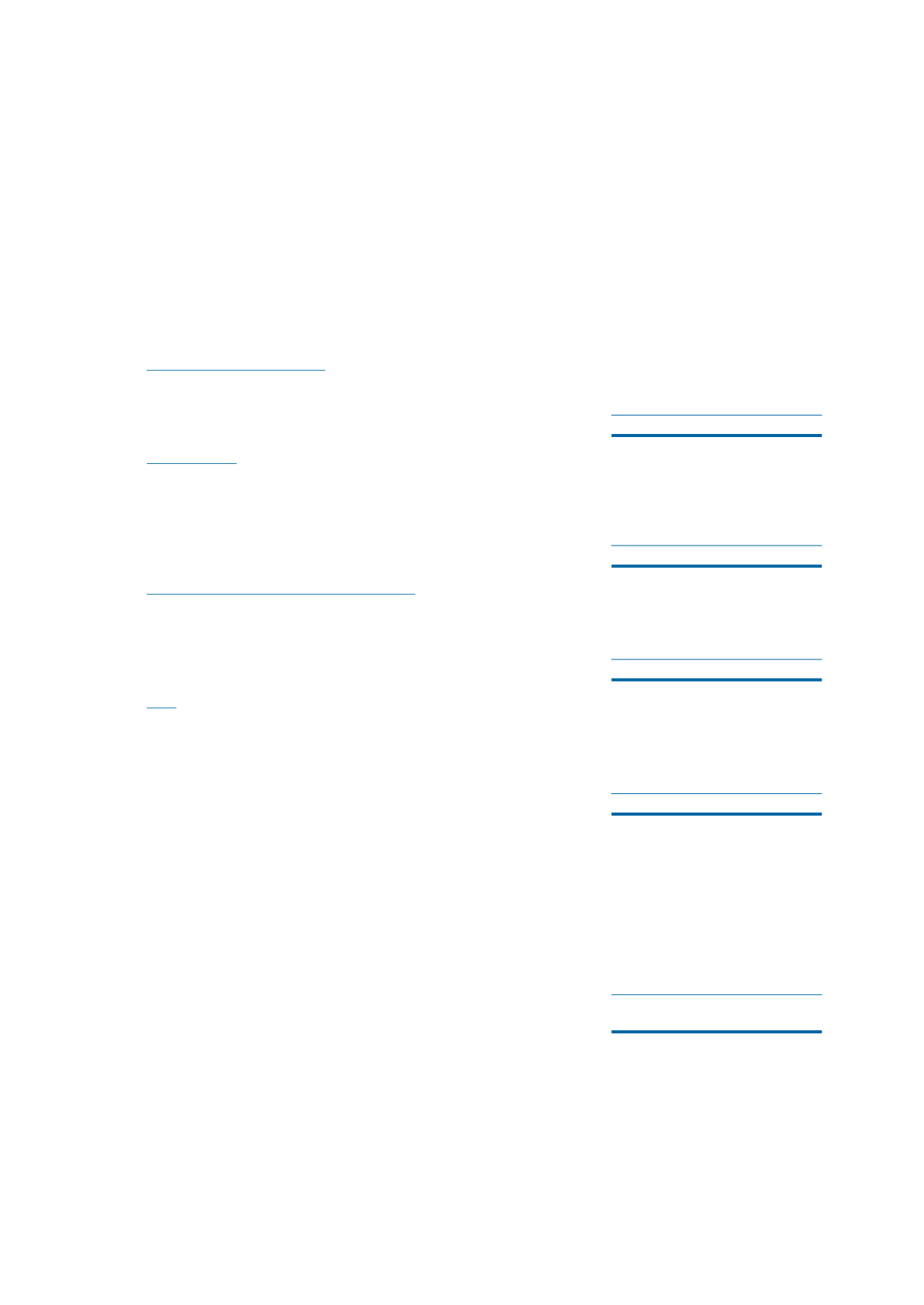

The movements in the deferred income tax assets and liabilities (prior to offsetting of balances within the

same tax jurisdiction) during the financial year were as follows:

The Group

Deferred income tax liabilities

2014

2013

$’000

$’000

Accelerated tax depreciation

Beginning of financial year

130

130

Charged to profit or loss

4

–

End of financial year

134

130

Fair value gain

Beginning of financial year

82

102

Currency translation differences

2

11

Charged/(credited) to other comprehensive income

(Note 31(b)(v))

83

(31)

End of financial year

167

82

Undistributed profits of foreign subsidiaries

Beginning of financial year

398

7,302

Currency translation differences

12

137

Charged/(credited) to profit or loss

294

(7,041)

End of financial year

704

398

Total

Beginning of financial year

610

7,534

Currency translation differences

14

148

Charged/(credited) to profit or loss

298

(7,041)

Charged/(credited) to other comprehensive income

83

(31)

End of financial year

1,005

610

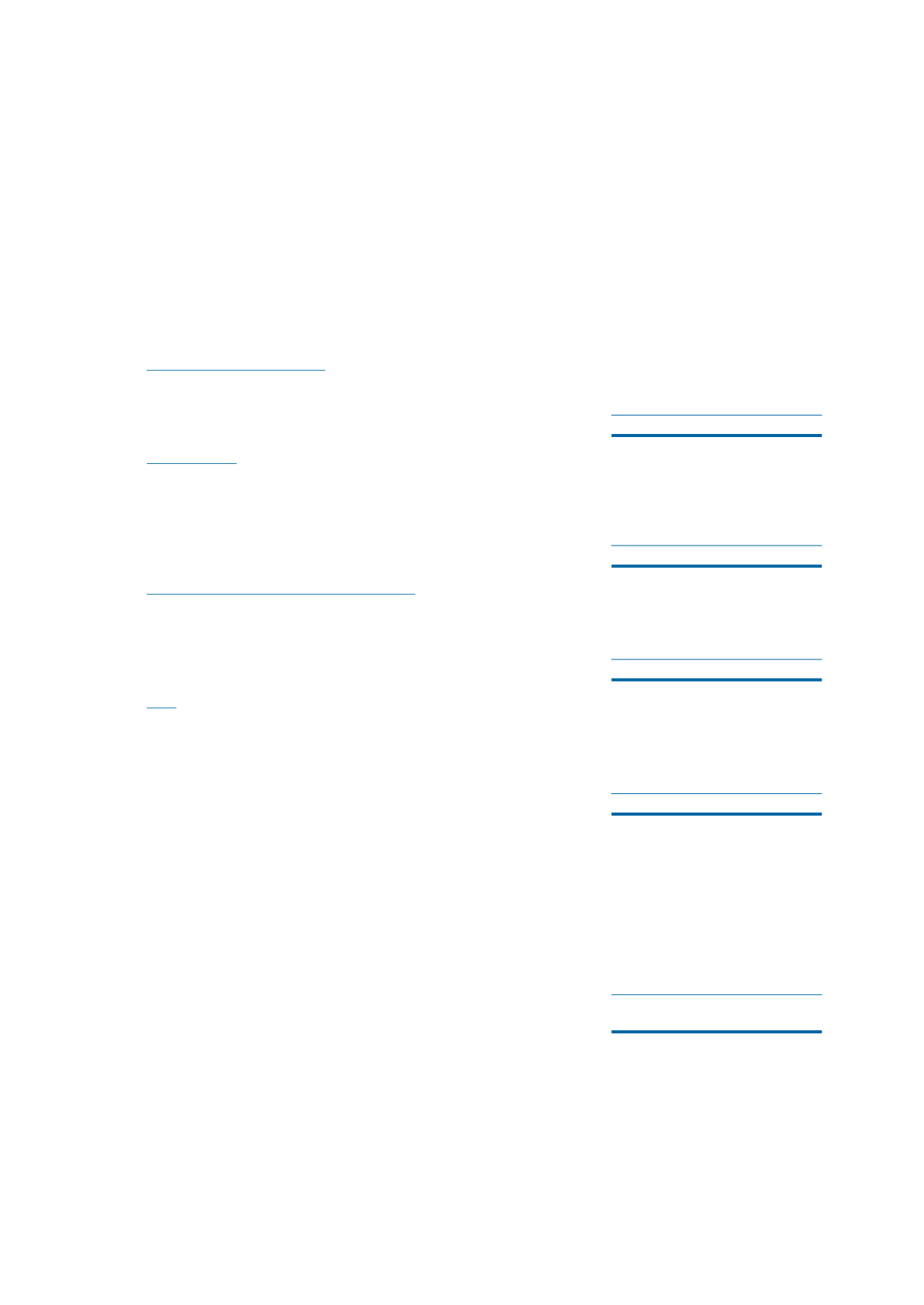

Reconciliation of total deferred income tax liabilities after appropriate offsetting from the same tax

jurisdiction is as follows:

The Group

2014

2013

$’000

$’000

Total deferred income tax liabilities

1,005

610

Offsetting of deferred income tax assets from the same tax jurisdiction

(168)

(82)

Total deferred income tax liabilities after appropriate offsetting

from the same tax jurisdiction

837

528